As highlighted in earlier tax alerts the financial incentives under the Multimedia Super Corridor MSC Malaysia Bill of Guarantee No. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai.

Alcohol Ban On Mas Flights Malaysia Truly Asia National Airlines Malaysia Airlines

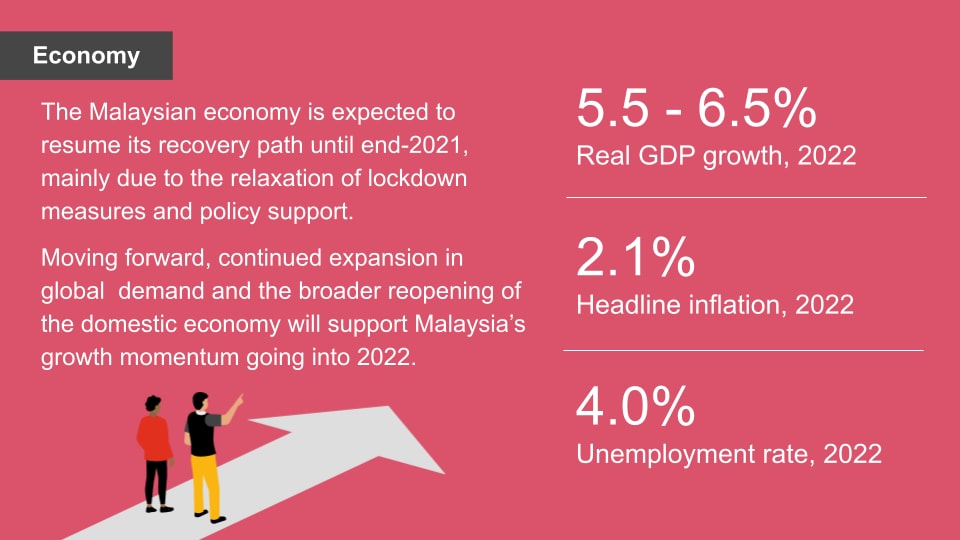

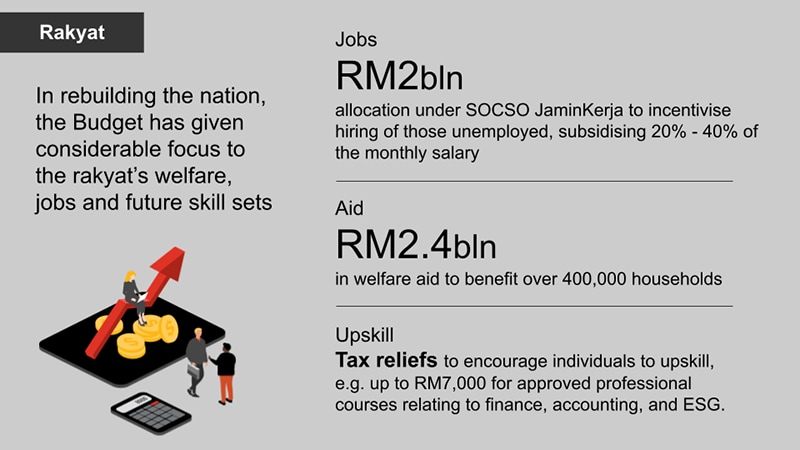

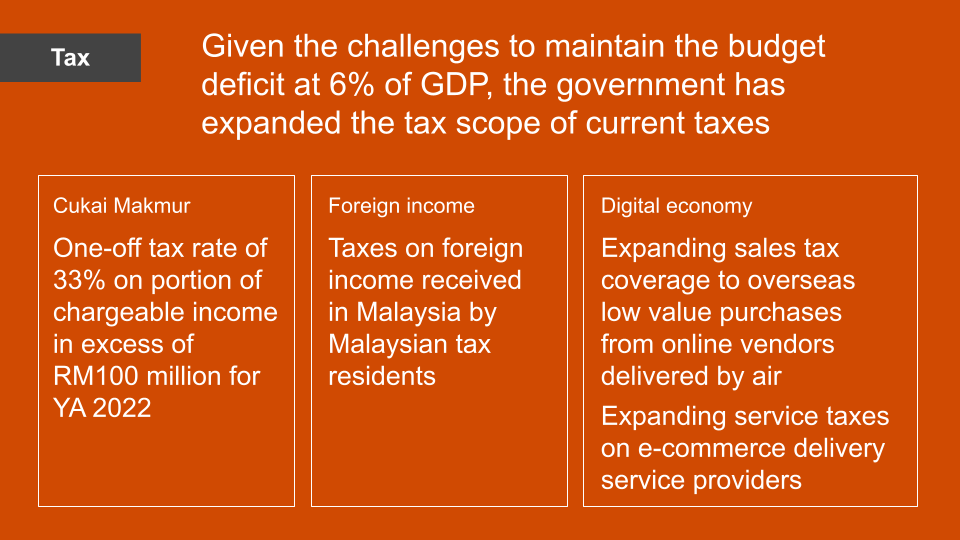

The new scheme for encouraging business growth by reducing the income tax rate by 1-4 for increases in chargeable income is a step in the right direction.

. Incentives that comply with FHTPs requirement must be gazetted by 31st December 2018. Tax incentive for women returning to work after career break It is proposed that a new tax exemption on employment income up to a maximum of 12 consecutive months be given to women who return to the workforce after a career break of at least 2 years on 27 October 2017. PS with tax exemption of 100 of SI.

Relevant Orders Income Tax Exemption No. The following incentives are given to encourage investment and relocation of manufacturing operations into Malaysia. PS with tax exemption of 70 of SI.

Any excess is not refundable. 6 2016 Amendment Order 2018 PU. Resident individuals are eligible to claim the following tax rebates which are to be deducted from tax charged.

These income tax rate. Average Lending Rate Bank Negara Malaysia Schedule Section 140B. PwC 20162017 Malaysian Tax Booklet INCOME TAX Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of airsea transport banking or insurance which is assessable on a world income scope.

It is proposed that with effect from the year of assessment YA 2017 the corporate income tax rate for the chargeable income up to RM 500000 will be reduced by 1 from 19 to 18 to ensure that SMEs remain competitive. Labuan Offshore Business Activity Act LOBATA 1990. Individual - Other tax credits and incentives.

The application for a capital allowance or income tax exemption must be made through the Malaysian Investment Development Authority within the timeframe provided in the orders for each. Free Zone Act 1990 Customs Act 1967. Customs Act 1967 Sales Tax Act 1972 Excise Act 1976.

Malaysia are taxed at 19 on chargeable income up to RM 500000 with the remaining chargeable income taxed at 24. Tax Incentives for Economic Development Regions 3. There are different types of tax incentives offered in Malaysia in the form of tax exemptions allowances related to capital expenditure and enhanced tax deductions.

5 BOG have been reviewed and amended to adhere to the minimum standards under Action 5 of the Organization for Economic Cooperation and Development OECDs Base Erosion and Profit Shifting BEPS Project see Tax Alert No. The article is written to provide an overview of the venture capital industry in Malaysia and the governments effort in promoting this industry and made reference to the Public Ruling 22016 Venture Capital Tax Incentives. Income Tax Act 1967.

Responsibilities Rights of Individual. 2018 Personal Tax Incentives Relief for Expatriate in Malaysia. ITA of 60 on QCE set-off against 70 of SI.

ITA of 100 on QCE set-off against 100 of SI. Manufacturer of selected ME and specialised ME. Although the income is exempted from tax tax will have to be paid on the dividends paid on tax exempted income.

Tax Incentives in Malaysia. If husband and wife are separately assessed and the chargeable income of each does not exceed MYR 35000. Companies which had been successful in increasing revenues will benefit from reduction in their income taxes for the year of assessment 2017 and 2018.

This is demonstrated through. This article is relevant for candidates preparing for the P6 MYS Advanced Taxation exam. The reduction of the SME income tax rate on the first RM500000 by 1 is also a welcomed change.

Incentives for companies in Malaysia Investments in a number of industries in Malaysia are facilitated by the available tax incentives. Major highlights for 2017 Malaysia Budget Marginal reduction of the corporate income tax rate on the annual incremental chargeable income for YAs 2017 and 2018 Reduction of corporate. Tax Incentives by Legislation.

Malaysia is also committed to align themselves to the global standards. Manufacturers producing promoted products or engaged in promoted activities. In the case of allowances there is a provision to carry forward the unutilized.

No distinction on tax treatment including transaction and currency restrictions between residents and non-residents. For expatriates working for Labuan International there is a special rebate where foreign directors income is zero tax and expatriate employees are subject to a 50 rebate in their. Green Technology Tax Incentive in Malaysia The government has mooted various initiatives to accelerate green technology adoption by the private sector.

The article is based on prevailing laws as at 31 March 2017. Malaysian Customs Department and the Companies Commission of Malaysia. Only RD expenditures incurred in Malaysia are eligible for Income tax exemption.

Promotion Of Investment Act 1986. This rule shall not apply to qualifying companies granted an exemption on or before 16 October 2017. Income attributable to a Labuan.

0 tax rate for 10 or 15 years for new companies that invest a minimum of MYR 300 million or MYR 500 million respectively in the manufacturing sector in Malaysia. Manufacturing information technology services energy conservation environmental protection or biotechnology are among the industries that have tax incentives available for investors. The applications must be submitted to Talent Corporation Malaysia Berhad.

For easier financing access the introduction of Green Technology Financing Scheme 20 GTFS helps to provide financial aid to companies with the government guaranteeing 60 of the loan amount and. If husband and wife are jointly assessed and the. A 2532017 allows an income tax exemption in respect of statutory income equivalent to the amount of the capital allowance determined under PU.

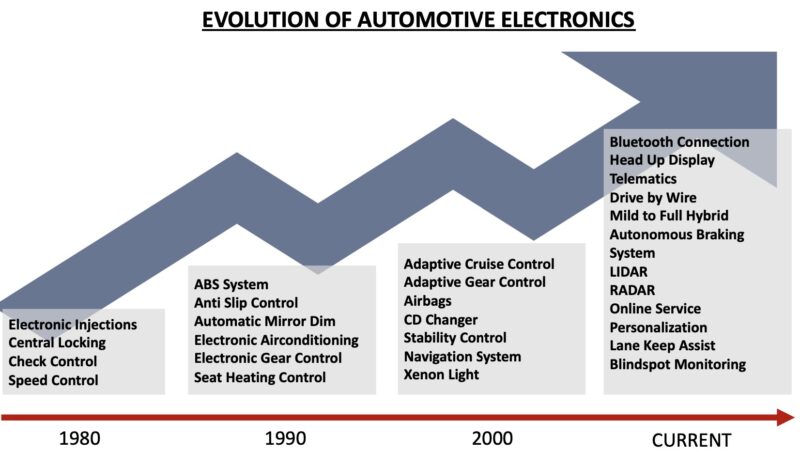

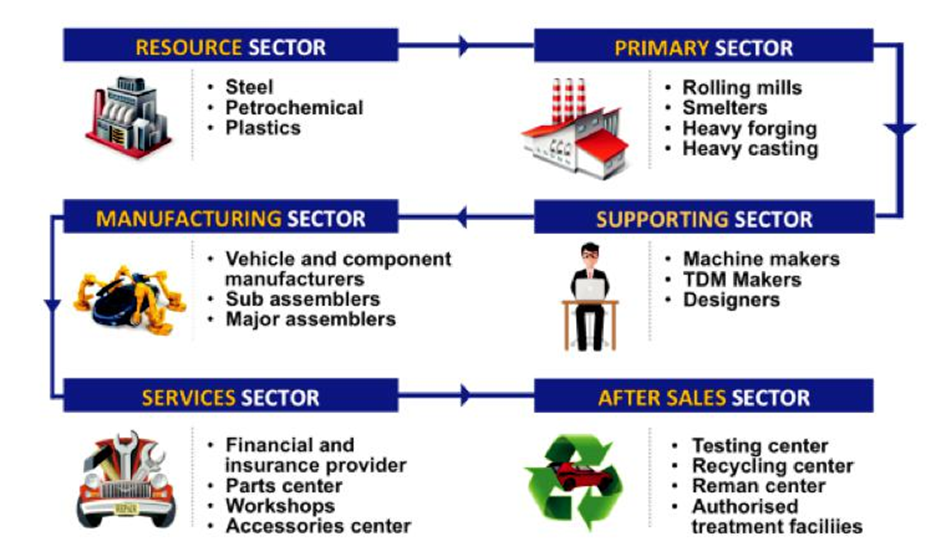

Malaysia Auto Industry Tapping On New Areas Of Opportunities Mida Malaysian Investment Development Authority

1 Household Wealth And Inheritances Inheritance Taxation In Oecd Countries Oecd Ilibrary

Pdf Addressing Malnutrition In Malaysia

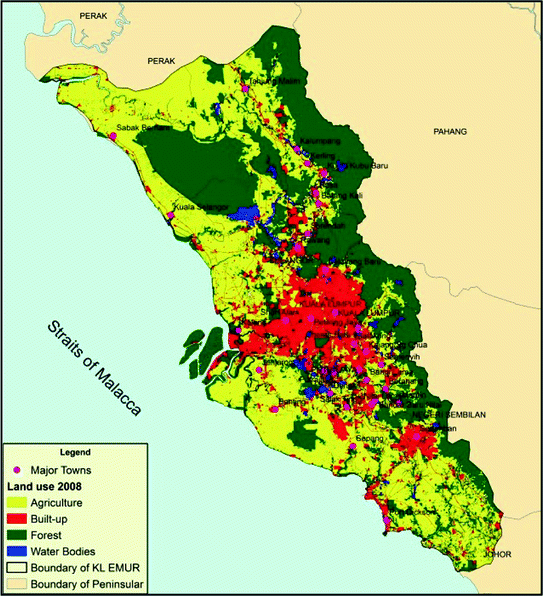

Going For Green Cities The Role Of Urban And Peri Urban Forestry In Creating The Ambiance Of The Liveable City In Malaysia Springerlink

Pdf Addressing Malnutrition In Malaysia

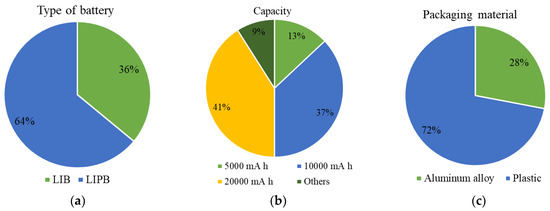

Sustainability Free Full Text Comparative Life Cycle Assessment Of Mobile Power Banks With Lithium Ion Battery And Lithium Ion Polymer Battery Html

Wolters Kluwer Malaysia Cch Books Tax Books

Pdf Agency Theory And Managerial Ownership Evidence From Malaysia

Malaysia Auto Industry Tapping On New Areas Of Opportunities Mida Malaysian Investment Development Authority

Tax In Malaysia Malaysia Tax Guide Hsbc Expat

Module Price Index Pv Magazine International

Wolters Kluwer Malaysia Cch Books Tax Books

Wolters Kluwer Malaysia Cch Books Tax Books